VANILLA MARKET UPDATE – MAY 2023

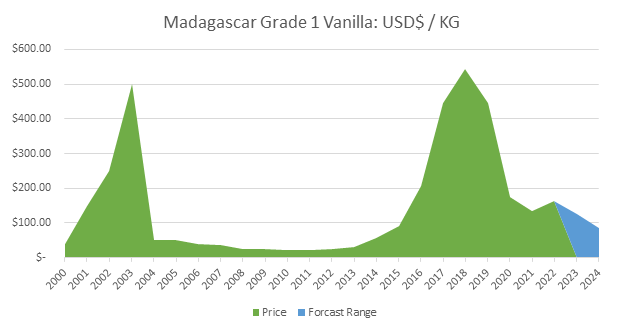

The global vanilla market is entering an extraordinary phase of falling prices and oversupply across all major growing regions. Although the circumstances are somewhat different, the situation is very similar to 2004 when vanilla prices fell 90% from the highs of approx. $500.00/kg to approx. $50.00/kg in the space of 12 months, slowly degrading further the following years and reaching lows below $20.00/kg in 2010 (prices indicated for G1 quality Madagascar vanilla beans). Boom and bust cycles are typical for a commodity like vanilla beans and are strictly a function of supply and demand. However, as will be explained later, unexpected factors such as government intervention, severe climatic events, and intense speculation can change the equation considerably.

The following report will lay out (from Aust & Hachmann Canada’s perspective) what is happening in the global vanilla trade and how the market arrived at the current situation and where it might progress to in the near-to medium-term.

Alternative Vanilla Growing Regions

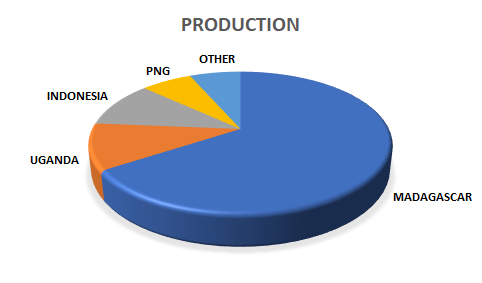

In the past A&H (Canada) has assessed each major vanilla growing region separately, but as evidenced by this most recent vanilla crisis, no other origin can challenge Madagascar in terms of market dominance. Today, even if we were to combine the total estimated production of the three other major vanilla growing regions (Uganda, Indonesia, and Papua New Guinea), it would not amount to half of the current Madagascar production. The market reality thus far has been that regardless of what happens in these three major growing regions, it will have little impact on the direction of the global vanilla trade.

Uganda

Vanilla production has increased significantly in Uganda over the past three years and may exceed 300mt in 2023. Quality has also improved dramatically, and more often than not, the top extraction grade vanilla from Uganda will easily exceed the equivalent grades from Madagascar in terms of vanillin content and flavor profile. In early 2022, when the Government of Madagascar ramped up enforcement of the minimum price policy, many industry watchers expected a migration of vanilla buyers to Uganda; a logical assumption given its excellent quality and significantly cheaper prices. Thus far, the reaction from buyers has been tepid at best, and a steadily increasing surplus hangs heavily over the Ugandan vanilla market. Any experienced vanilla buyer knows full well that the only way to end the Madagascar’s dominance of the global vanilla trade is to create a competitive balance between Madagascar and other vanilla growing regions.

Uganda is the best position to supply what is arguably the most botanically similar vanilla to Madagascar available. Furthermore, Ugandan vanilla production has reached a level that, if supported, could soon exceed 500mt. This would represent about 20% of worldwide production. Sadly, the flavor industry, for the most part, continues its somewhat incomprehensible support of Madagascar vanilla no matter what the circumstances may be, and by extension, enables its dominance of the global vanilla trade. Reasons such as brand recognition, the inconvenience of label changes and reformulation seem counterproductive. We believe that if vanilla prices fall to levels last seen from 2006 – 2011, Ugandan vanilla farmers will abandon their plots and production will fall dramatically. The same can be said for neighboring Tanzanian vanilla production, which is in its nascent stage. These two outcomes, if allowed to happen, will only enforce Madagascar’s dominance for years to come.

Indonesia and Papua New Guinea

Indonesia and Papua New Guinea’s vanilla productions are poised to suffer as well in the years ahead. If vanilla prices go below $50.00/kg, which is a very real possibility at this point, making it less economically viable to bring PNG vanilla for processing and export from Indonesia. We believe that the combined production from both origins (also on the rise in past years) could easily exceed 500mt in 2023. From experience, A&H (Canada) would expect Some Indonesian vanilla exporters to store their unsold inventories and wait the bear market out, focusing on other commodities such as cloves or cinnamon. Some Indonesian exporters held their inventories for almost a decade after the last crisis, as they are financially far better equipped to carry inventory compared to their counterparts in either PNG or Uganda.

If Indonesian traders pulls back from PNG, the situation on the ground could become dire as far as vanilla is concerned. However, if the last crisis is any indication, PNG exporters will follow the market regardless of the price. During the previous crisis the market saw vanilla from this origin go below USD$10.00/kg, a clearly unsustainable level over the long run.

Madagascar

The first years after vanilla prices hit a peak above $600.00/kg. about 6 years ago, a slow and steady decline ensued. Initially this was the result of a combination of factors, namely an unsustainably high price combined with poor quality and plummeting demand, just as was witnessed in 2004 – 2005, after prices peaked above $500.00/kg. In 2020, as COVID took over the world, there was a rebound in demand for industrial vanilla as retail grocery activity boomed. This temporarily arrested the decline in prices. From 2020 through the first half of 2022, vanilla prices were stable and exports from all origins were very strong. Increasingly abundant vanilla production (mostly because of new plantings) foretold further price erosion soon to come. In the meantime, the short-term spike in demand and prices for vanilla drew government scrutiny. The enforcement of rules and regulations within the sector, such as opening harvest dates, closing export dates and repatriation obligations were far more rigidly applied. In addition, the issuance of export licenses became highly politicized and were granted only when an exporter’s income tax obligations, however questionable, were settled.

It was in early 2020 when the idea of a fixed minimum export price gained a foothold within the vanilla sector. The Government set an initial minimum price at $350.00/kg, which was so far off the actual vanilla price on the ground that it was virtually ignored by all exporters. By late 2020 the government revised the minimum export price to USD$ 250.00/kg and insisted that exporters repatriate this amount per kilo of vanilla exported into local currency within 90 days of exporting, despite it being over $100.00/kg above the actual market price on the ground. For the most part exporters complied, not by forcing their clients to pay artificially high prices (which the buyers would not have accepted) but rather by finding the USD offshore to make up the spread between their selling price and the minimum $250.00/kg to meet their repatriation obligations. This added costs but was feasible for the 2021/2022 season and Madagascar exported over 3000mt. Unfortunately, this figure did not represent a sudden explosion in demand but rather a foretelling of troubles ahead in the vanilla market.

In early 2022, the government decided to ratchet up enforcement of the minimum price policy and make it more difficult for exporters to make up the difference between the selling price and official export price simply by buying USD on the open market, mostly from money traders in Mauritius. They were convinced that the market could and should pay at least $250.00/kg since only a few years earlier it had paid over $600.00/kg. A very flawed rationale in our opinion. Suddenly, exporters were being hit with tax audits using the $250.00/kg price as a benchmark to calculate their export revenues. The exporters’ actual selling prices were in fact much lower. This resulted in large, unexpected, tax bills which had to be settled before any exports of vanilla were permitted. In addition, a special group of exporters was formed called the Conseil National de la Vanille or CNV. Members were ardently pro fixed price policy, and the organization quickly took control of the direction of vanilla policy in Madagascar. Several high-profile meetings were organized between the CNV and major vanilla buyers. The first and most famous July 4th, 2022, at the Madagascar embassy in Paris. Buyers were encouraged to sign a document which committed them to respect the minimum export price of USD$ 250.00/kg, divulge their local suppliers, and estimate how much vanilla they would buy at the government fixed minimum price. The document was known as the AMI, and very surprisingly many international companies signed on as they feared they would be cut off from their supply of Madagascar vanilla. In A&H (Canada)’s opinion, it is very unlikely there was any real intent from any of the signatories to buy at the minimum price of USD$ 250.00/kg.

At this stage, just a few months before the opening of the 2022/2023 campaign, one can understand why the government thought their plans would succeed. According to their figures, they had signed commitments to buy over 5000mt of vanilla at the official price of $250.00/kg. Plus, they had just finished a season where a record 3000+mt of vanilla had been exported, thus believing the demand for Madagascar vanilla was increasing dramatically. Unfortunately, we believe the actual situation within the vanilla market was badly misread, resulting in several decisions which ultimately made matters worse.

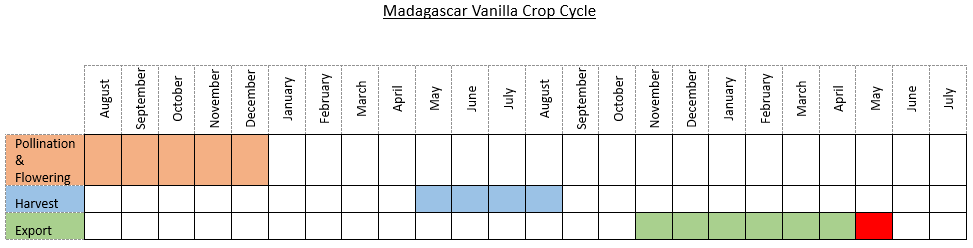

We do believe Madagascar exported over 3000mt from the 2021/2022 crop, but this was not due to an explosion in demand. It was largely buyers covering their needs and hedging well into 2023 as they were fearful that the hardening minimum price policy could in fact succeed, at least over the short term. As a result, long term positions for vanilla were solidified. This was made blatantly obvious at the outset of the 2022/2023 season when demand was practically non-existent. This seemed to spook the CNV and those who backed the minimum price policy. The opening of the export season was then delayed from Sept 15th to Nov 15th, 2022, to try and create tension in the market, we presume. However, the effect was muted at best. Today, almost 6 months after the opening of the 2022/2023 campaign, we do not believe Madagascar has even exported one third of the 2022/2023 vanilla crop which is estimated to be well over 2200mt. The coming 2023/2024 crop is also estimated to be very large as well. This is on top of a carry-over inventory from the 2021/2022 crop estimated at 750 – 1000mt. That makes for an extremely over supplied vanilla market going forward.

Dates for the closing of the 2022/2023 Madagascar vanilla season have yet to be officialized. Prices have fallen dramatically in the past months as it becomes apparent that demand is not recovering as expected and 2023 will yield another large crop, probably well over 2000mt. As always, rumors circulate that the CNV is poised to take further action and more restrictions will soon be announced. Perhaps the CNV should focus on the lower grade vanillas which make up most unsold inventories. Here is where we see the most significant price erosion. In our opinion, a short-term ban on the export of cuts or G3 quality from Madagascar would go a long way to stabilizing the market and perhaps avoid an outright crash which today seems inevitable. It is interesting to note that the last time Madagascar had a fixed price policy with the export price being set at $74.00/kg, the export of lower qualities, such as cuts and short beans, was not permitted. Lower grade vanilla beans were stocked in government-controlled warehouses, and in some cases, even destroyed.

Conclusion

In our opinion it was extremely unrealistic that in the face of such massive global production of vanilla, a minimum price policy, almost double of the actual price on the ground, would have any chance of being successfully implemented. Furthermore, it was naïve to think that global flavor companies would be ‘force fed’ a price that had no market basis and would have little benefit for vanilla farmers or their communities – despite the CNV’s efforts to promote the policy as such. The 3000mt exported from the previous season was a clear signal that many buyers were not taking any chances with the 2022 vanilla crop.

Why so many international companies signed on to this impossible policy when we do not believe there was any intent of paying the $250.00/kg remains somewhat of a mystery. In our opinion, it made a bad situation worse by giving the false impression that the fixed price policy was supported by the vanilla industry, which for the most part was not the case. We feel that the underestimation of global vanilla production, as well as the nature of the flavor industry, led to flawed vanilla policy decisions.

Although we prefer a free and open vanilla market, if the price is to be fixed, we believe it should be done with serious consideration for the actual market price, not just in Madagascar but also in other vanilla growing regions. We feel it is far more important to protect vanilla prices from falling to unsustainable levels like we saw from 2005 – 2011 than trying to keep prices artificially high. Vanilla, albeit a critical flavor component, is not a commodity that can be so simply regulated. It can easily be substituted, given the very lax enforcement of flavoring regulations and the easy availability of both natural and synthetic vanilla flavoring substitutes. In addition, as we have pointed out in previous reports, the usage and labelling of naturally flavored vanilla products in the food industry is still a highly contentious subject as evidenced by several ongoing class action lawsuits against companies allegedly misrepresenting their applications of natural vanilla.

The situation in the global vanilla market is critical as unsold vanilla stocks flounder in warehouses both at origin and in Europe and North America. Buyers for the most part remain on the sidelines presumably waiting for things to stabilize. We have already seen a 30-50% drop in price, depending on quality, since the outset of the 22/23 campaign.

The combination of excess inventory and strong production presents a significant challenge. Prices could test new lows just as they tested new highs at the top of the cycle. To put that in perspective, prices fell well below $20.00/kg the last time the market faced these types of challenges. We believe many companies on the ground in the vanilla region of Madagascar and from other origins will not survive the current crisis. Today the projected green vanilla price for the upcoming Madagascar crop is barely above $1.25kg.

That translates into potential $20.00/kg vanilla, a price that suits no one. The Madagascar Government insists that the minimum price for green vanilla from the 2022/2023 crop will be set at 75,000 Ariary, or about USD$ 18.00/kg. But this is not realistic in our opinion as there is absolutely no way, currently at least, to control or regulate the price paid to farmers for green vanilla in Madagascar.

Ironically, what could save the market from horrifically low prices are professional speculators, as was the case during the previous cycle when prices fell below $20.00/kg. Thousands of metric tons of vanilla were purchased and stored in warehouses in Europe and the USA from 2006 – 2012, mostly first grade extraction beans. These can be shelf stable for many years when the correct qualities are selected, properly warehoused and packaged for the long term. In fact, one of the biggest traders in vanilla today started on a speculative basis after the last price crash, taking a very large position on extraction grade vanilla. Subsequently they decided to remain in the market after it recovered and have gone on to become one of the world’s largest dealers in vanilla. Others did quite well with their positions but had to wait many years before their positions became profitable. There are commodity speculators all over the world looking for the next opportunity. We have little doubt that a new wave will be attracted to very cheap vanilla when prices approach the bottom. The only question is how low prices will have to fall before the demand starts once again to exceed supply. Either way, barring some unforeseen catastrophe, we believe the global vanilla trade is entering a prolonged period of low prices and over supply. A long and bumpy road lies ahead.

Aust & Hachmann (Canada) Ltd

The market reports that we issue are based strictly on our opinions and observations. We have made our share of mistakes over the years but for the most part we believe we have presented a reasonably accurate portrayal of the global vanilla market in very general terms. The reports date back almost 20 years and are all available on our web site: https://www.austhachcanada.com/ reports/

Recent Comments