VANILLA MARKET UPDATE – MAY 2022

Presumably the 2021 Madagascar vanilla export season will end on June 30th for stocks declared prior to May 31st (rumors abound the dates will be extended, but as of yet there is no confirmation). Consumption of natural vanilla products continues to accelerate with strong demand from the industrial and retails sectors while the food service and institutional markets continue to recover from the effects of COVID. It has become increasingly apparent that in 2021 vanilla production for certain origins (Madagascar and Uganda in particular) was underestimated by a significant margin. We believe this will have a noticeable impact on the vanilla market going forward.

The Madagascar government continues to enforce the minimum export price for vanilla currently set at USD 250.00/kg. But as was the case last year, the actual market price for vanilla has been far below this level and exporters find more and more ingenious methods to make up the difference between the actual selling price and the mandated export price without contravening the minimum price policy. Most major international buyers remain focused on Madagascar for their vanilla needs and there has not been any significant migration to other vanilla origins thus far.

Herewith are our projections and opinions for the major vanilla growing regions. As always, this information is subject to change and interpretation. All of our previous market reports going back several years are available on our web site. https://www.austhachcanada.com/reports/

Papua New Guinea

The trend of PNG vanilla finding its way to world markets via Indonesia continues. In 2021, PNG probably produced 300mt and we would expect a similar number in 2022. It is very difficult to estimate carryover stock and actual exports to end users. Suffice it to say that industrial acceptance for PNG vanilla is still limited and will probably remain that way for some time. There are still no real standards of quality for industrial grade vanilla in PNG. Moisture and vanillin contents can be very inconsistent and there is little microbiological analysis and pesticide testing done on the ground. With food safety standards becoming more rigid each year, these inconsistencies will become more of a challenge for PNG going forward. Although we consider the Tahitensis species as the true PNG vanilla, there is a significant amount of sub-standard Planifolia species still circulating. This creates a lot of confusion for buyers and makes it very difficult to establish consistent industrial vanilla flavoring formulations. In our opinion the most hopeful markets for this origin are the food service and retail sectors where vanilla specifications and labeling requirements are less rigid. Although PNG has traditionally enjoyed a competitive advantage over other vanilla origins, air cargo rates which are 3 times higher than just a few years ago are eating up much of that difference. The current world-wide logistical challenges impact PNG to a far greater degree than other vanilla origins.

Indonesia

Vanilla production in Indonesia becomes more and more difficult to estimate given the large quantities of PNG vanilla which are now brought into the country and re-exported as Indonesian vanilla. Blending is problematic given the very unique profile of PNG vanilla. This is mostly evident with the Tahitensis species which can impart a very particular and undesirable note on Bourbon type vanilla even when blended at very low ratios. One way or the other, we do expect at least 300mt of vanilla production from Indonesia in 2022. Although prices for Indonesian vanilla were quite strong at the outset of 2022, they have softened recently as most international buyers have turned their attention to Madagascar before the export season officially ends on May 31st.

Uganda

Export volumes for vanilla from Uganda have exceeded expectations for 2021, and we now believe the country produced at least 150mt of vanilla beans. With good growing conditions so far in 2022, Uganda should easily surpass 200mt this year from their bi-annual vanilla harvests. It is still not clear to what extent Tanzania is contributing to this figure, but we are of the opinion that it is not yet significant. As we have previously stated Ugandan quality has improved dramatically over the past years. However, as production and volumes increase, maintaining quality will become more challenging due mostly to a lack of qualified vanilla technicians on the ground. Moisture contents, on whole vanilla beans still tend to be too high, approaching or exceeding the upper end of tolerance levels for the North American market (25%). We feel Uganda still focuses too much on gourmet/black vanilla as this quality usually commands a higher price than extraction grade. This results in a lot of substandard gourmet beans that should have been dried further and reclassified as extraction grade.

In our opinion Uganda will still have to sell its vanilla at a significant discount to Madagascar vanilla in order to increase global market share.

Comoros

The status quo continues in the Comoros islands where some of the best quality bourbon vanilla is cultivated. Crop size will be slightly larger this year and may eclipse 50mt. Prices will probably be slightly higher than Madagascar and the government will set the minimum price for green vanilla shortly. Unfortunately, the market continues to be controlled by just a few exporters who continue to resist any attempts to expand vanilla production. This is the same problem that exists in French Polynesia where vanilla production has stagnated for years and shows little signs of growing. However more recently we have seen some new entities trying to break the quasi monopoly that exists in the Comorian vanilla market.

Madagascar

The 2021 Madagascar vanilla crop was indeed a bumper crop. Although we had originally projected the crop size to be between 2000 and 2300mt we now believe it was more likely closer to 3000mt. A leaked document, detailing vanilla exports declared at customs from the towns of Sambava and Antalaha, the two major exporting points in the vanilla region of Madagascar, proved to be quite illuminating.

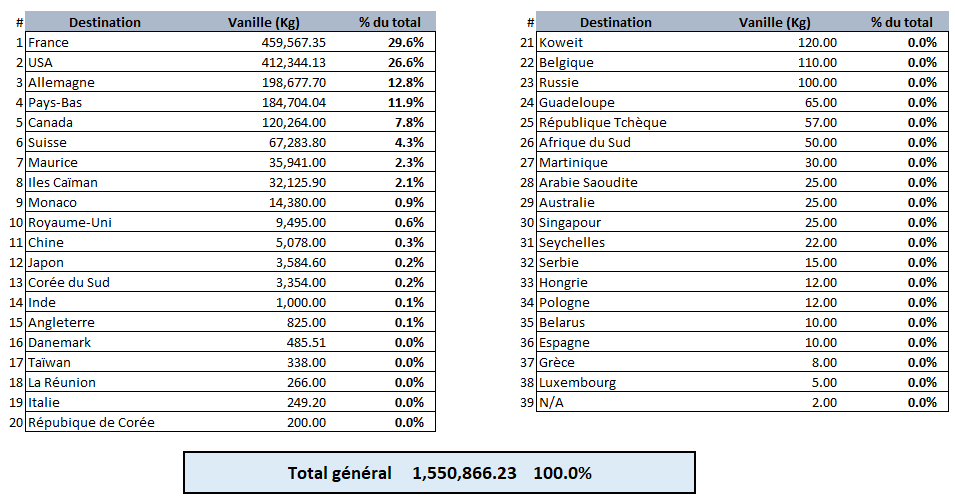

Vanilla exports by destination from 9/15/21 through 30/3/22, Sambava and Antalaha.

This table details vanilla bean exports from the opening of the 6 ½ month season. This represents an average of approximately 238mt monthly.

If one assumes similar numbers for April and May, it’s perfectly plausible exports declared from Samabva and Antalaha alone will be close to 2000mt from the 2021 crop. In addition, there are the exports by sea freight which leave from the ports of Tamatave and Diego Suarez. More significantly still is the vanilla which is trucked directly to the airport in Antananarivo which represents all the vanilla produced in the region of Tamatave being shipped by air freight. Exporters from the Sava who prefer to ship their vanilla direct by truck to the international airport in Antanarivo as opposed to the port of Antalaha by feeder vessel and onward by truck to Antananarivo. This is the preferred routing for exporters who try to be more discreet about the quantities of vanilla they are exporting. Antalaha is a small town where movements of vanilla are heavily scrutinized and talked about. We believe that vanilla exported through points other than Antalaha and Sambava could be at least 500mt. Add to this the expected carryover stock for the 2021 crop (conservatively estimated at 500mt) and it is quite plausible that for 2021, vanilla production was close to or even exceeded 3000mt.

A side note of interest is the fact that EU countries are now importing almost double the quantities of vanilla beans than their North American counterparts. This is a fairly recent development (last 10 years) as the U.S. market was always the dominant force in the global vanilla trade.

We are also of the opinion that many of the dire predictions made for the 2022 Madagascar crop were either announced too prematurely or were simply attempts at influencing market activity. We believe earlier talk of a massive shortfall and poor quality for the 2022 crop were impossible to verify at that point in the crop cycle. In any case, even if the 2022 crop yielded 40% less vanilla than in 2021, which we deem extremely unlikely, it could still theoretically produce 1800mt of vanilla beans. Talk of poor quality has been very premature as well. It is still far too early to establish quality for the 2022 vanilla crop. In fact, current reports indicate a mature crop with a large percentage of longer beans. A strong late flowering and abundant rain during the growing season should impact yields positively.

Unfortunately, the minimum export price policy set by the government is expected to be maintained at USD 250.00/kg. There is also much talk about setting a minimum price for green vanilla on the ground. But as was the case last year, we believe it will be mostly ignored as it is unenforceable. As always, the market will decide the real price and exporters will do whatever they have to do to make up the difference between the real selling price and the official export price so that they do not run afoul of government repatriation requirements for foreign currency.

The question on everyone’s mind is which exporters will be granted export licenses for the 2022 vanilla campaign. This has become a somewhat arbitrary and rather secretive, closed process. If last year is any indication, we may only have a few days’ notice prior to the export opening (presumed to be September 15th), before the list of accredited vanilla exporters is released. Trying to establish long term contracts for vanilla is very risky when dealing with these types of unpredictable variables which do not exist in a free and open vanilla market.

As was pointed out in our last report, companies who produce vanilla extracts in Madagascar or who are involved in joint ventures with local partners need not be concerned about the minimum price policy affecting their bottom lines. Thus far, there is no minimum export price policy for vanilla extracts out of Madagascar that we are aware of. Local manufacturers of vanilla extracts can buy vanilla beans directly from collectors or vanilla associations at half the official export price, or less.

One could argue that the minimum price policy has been a huge success for Madagascar. It has allowed for a much larger injection of foreign currency into the Malagasy economy than otherwise would have been realized in an open and free vanilla market. However, as the stocks of unsold vanilla increase year over year on the ground, as vanilla production rises and prices fall in other origins, one wonders what the government’s plan will be when the situation becomes untenable. We simply do not see the policy as being sustainable over the long run as it contradicts the basic laws of supply and demand. At some point, the buildup of unsold vanilla inventory must be taken off the market in order to avoid a calamity.

Conclusion

We remain optimistic for the global vanilla trade but there are headwinds which cannot be ignored. COVID is receding and demand for authentically flavored vanilla products continues to rise. The leisure and tourist industries are recovering and food ingredient labeling is being more scrutinized than ever. All good things for vanilla. However, rising interest rates will increase financing costs considerably and should a recession occur, consumer spending will eventually subside. The war in Europe is a wild card nobody wants to even contemplate.

Vanilla prices on the ground have already softened somewhat as the export market comes to a close and many speculators seem to be having a last-minute change of heart and are trying to liquidate their stocks. Going forward we expect prices to remain stable over the short term, but they could possibly soften in the latter part of 2022 for reasons mentioned previously. On the other hand, if demand continues to grow and COVID retreats from the landscape, the vanilla market should remain stable. We believe global vanilla production exceeded 3500mt in 2021. We see a strong possibility of a growing vanilla bean surplus which normally would make us quite bearish on vanilla prices. However, the Madagascar vanilla policy will once again weigh heavily on the direction of the global vanilla market.

Aust & Hachmann (Canada) Ltd/Ltee

Recent Comments